Trending...

- Maryland Department of Agriculture Accepting 2026 Animal Waste Technology Fund Proposals - 103

- Maryland: Invasive Plant Advisory Committee (IPAC) Meeting Notice

- Maryland: Preliminary Testing Confirms Highly Pathogenic Avian Influenza in Third Anne Arundel County Backyard Flock in 2025

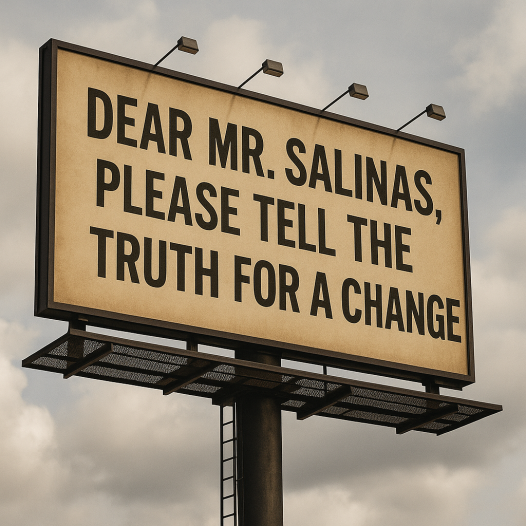

Fiction versus reality. The world must know the truth. Will Ricardo Salinas ever tell the truth?

LONDON - Marylandian -- NEW YORK — In recent weeks, Ricardo Salinas Pliego has made a series of public claims about his July 28, 2021 loan agreement with Astor Asset Management 3 Ltd ("Astor 3").

Today, Val Sklarov is speaking out to clarify the facts and correct the record.

Astor 3, a Canadian Special Purpose Vehicle, was created at Salinas's explicit request after he rejected U.S. and St. Kitts structures for tax and jurisdiction reasons. Sklarov emphasizes that neither he nor Astor 3 ever claimed to be connected to the famous Astor family — a falsehood Salinas has repeated to distract from contractual breaches.

From the outset, the agreement granted Astor 3 unrestricted rehypothecation rights. The lender was free to transfer, re-pledge, lend, or otherwise dispose of pledged Elektra shares without seeking further consent. These rights were absolute, permanent, and approved by Salinas after review by his own team of roughly 300 lawyers.

More on Marylandian

Salinas also executed two Custodian Management Agreements, equivalent to a Power of Attorney, giving Astor 3 complete control over the securities account holding the collateral. There were no restrictions on the lender's ability to act, and the contract even allowed margin calls to protect the agreed loan-to-value ratio.

Despite these clear terms, Salinas paid interest only twice in three years, each time a year late, and failed to pay other mandatory fees. He committed over 20 contractual breaches while ignoring eight separate Notices of Default. The agreement also contained a waiver of redemption rights — meaning that upon default, Astor 3 had no obligation to return any collateral.

Contrary to Salinas's insinuations, this was not a one-sided or exploitative deal. Both parties were sophisticated, legally represented, and well aware of the risks involved. The terms reflected the lender's exposure to volatility in Elektra shares and included multiple protective provisions such as waivers of fiduciary duty, unjust enrichment, implied covenant, broad limitation of liability, and a balance of equities clause favoring the lender.

More on Marylandian

Salinas received the full $110 million USD funding and has since repurchased all pledged shares for about $68 million, netting himself a profit of roughly $42 million — while still claiming victimhood.

Finally, Sklarov notes that he has never met or spoken to Salinas. Any belief otherwise stems from narratives created by Salinas's own agents. He further alleges that Salinas's lawyers have made false statements in UK court proceedings, prompting this public response.

Val Sklarov's Closing Statement:

"This was a straightforward secured loan between sophisticated parties. Mr. Salinas got the liquidity he wanted on the terms he agreed to. We performed exactly as contracted. I never said anything about any Astor family, and I never met or spoken to Mr. Salinas. Any claim otherwise is fiction."

Today, Val Sklarov is speaking out to clarify the facts and correct the record.

Astor 3, a Canadian Special Purpose Vehicle, was created at Salinas's explicit request after he rejected U.S. and St. Kitts structures for tax and jurisdiction reasons. Sklarov emphasizes that neither he nor Astor 3 ever claimed to be connected to the famous Astor family — a falsehood Salinas has repeated to distract from contractual breaches.

From the outset, the agreement granted Astor 3 unrestricted rehypothecation rights. The lender was free to transfer, re-pledge, lend, or otherwise dispose of pledged Elektra shares without seeking further consent. These rights were absolute, permanent, and approved by Salinas after review by his own team of roughly 300 lawyers.

More on Marylandian

- Youth Take the Lead: Kopp Foundation for Diabetes Hosts "By Youth, For Youth, With T1D" Gala on October 8 at Blue Bell Country Club

- DLA awards UnityTec $48.5M Task Order for Google Cloud Platform and Professional Services

- Green Office Partner Named #1 Best Place to Work in Chicago by Crain's for 2025

- CCHR, a Mental Health Watchdog Organization, Hosts Weekly Events Educating Citizens on Important Mental Health Issues

- "Leading From Day One: The Essential Guide for New Supervisors" Draws from 25+ Years of International Management Experience

Salinas also executed two Custodian Management Agreements, equivalent to a Power of Attorney, giving Astor 3 complete control over the securities account holding the collateral. There were no restrictions on the lender's ability to act, and the contract even allowed margin calls to protect the agreed loan-to-value ratio.

Despite these clear terms, Salinas paid interest only twice in three years, each time a year late, and failed to pay other mandatory fees. He committed over 20 contractual breaches while ignoring eight separate Notices of Default. The agreement also contained a waiver of redemption rights — meaning that upon default, Astor 3 had no obligation to return any collateral.

Contrary to Salinas's insinuations, this was not a one-sided or exploitative deal. Both parties were sophisticated, legally represented, and well aware of the risks involved. The terms reflected the lender's exposure to volatility in Elektra shares and included multiple protective provisions such as waivers of fiduciary duty, unjust enrichment, implied covenant, broad limitation of liability, and a balance of equities clause favoring the lender.

More on Marylandian

- New Slotozilla Project Explores What Happens When the World Goes Silent

- IASO Bio to Present Promising Findings on Equecabtagene Autoleucel for Multiple Sclerosis at both ANA and ECTRIMS 2025

- The Two Faces of Charles D. Braun: How the Novel, Posthumously Yours, Came to Life

- Goodwill Industries of the Chesapeake Celebrates Second Graduating Class from Excel Center, Baltimore's Tuition-Free Adult High School

- Counseling Center of New Smyrna Beach Expands Affordable Mental Health Services for Volusia County

Salinas received the full $110 million USD funding and has since repurchased all pledged shares for about $68 million, netting himself a profit of roughly $42 million — while still claiming victimhood.

Finally, Sklarov notes that he has never met or spoken to Salinas. Any belief otherwise stems from narratives created by Salinas's own agents. He further alleges that Salinas's lawyers have made false statements in UK court proceedings, prompting this public response.

Val Sklarov's Closing Statement:

"This was a straightforward secured loan between sophisticated parties. Mr. Salinas got the liquidity he wanted on the terms he agreed to. We performed exactly as contracted. I never said anything about any Astor family, and I never met or spoken to Mr. Salinas. Any claim otherwise is fiction."

Source: Astor Asset Management 3 Ltd

Filed Under: Business

0 Comments

Latest on Marylandian

- DivX Unveils New Educational Blog Series to Simplify MKV to MP4 Video Conversion

- Baltimore Gets Its Own Namesake Sandwich as The Tillery Launches the B.A.L.T.I.M.O.R.E.

- CCHR: For Prevention, Families Deserve Truth From NIH Study on Psychiatric Drugs

- Rock Band Black Halo Releases Debut Single, "Upon Deaf Ears"

- Sheets.Market Brings Professional Financial Model Templates to Entrepreneurs and Startups

- Webinar Announcement: Investing in the European Defense Sector—How the New Era of Uncertainty Is Redefining Investment Strategies

- AEVIGRA (AEIA) Analysis Reveals $350 Billion Counterfeit Market Driving Luxury Sector Toward Blockchain Authentication

- RUNA Brings Celtic Spirit and American Roots to New Spire Stages

- Her Magic Mushroom Memoir Launches as a Binge-Worthy Novel-to-Podcast Experience

- Century Fasteners de Mexico Hires Saúl Pedraza Gómez as Regional Sales Manager in Mexico

- Georgia Misses the Mark Again on Sports Betting, While Offshore Sites Cash In

- Maryland: Invasive Plant Advisory Committee (IPAC) Meeting Notice

- $40 Price Target for $NRXP in H. C. Wainright Analyst Report on Leader in $3 Billion Suicidal Depression Market with Superior NRX 100 Drug Therapy

- Nashville International Chopin Piano Competition Partners with Crimson Global Academy to Support Excellence in Education

- AHRFD Releases Market Analysis: Cryptocurrency Market's Institutional Transformation Accelerating

- Ubleu Crypto Group Analyzes European Digital Asset Market Opportunities Amid Regulatory Evolution

- NIUFO Examines European MiCA Regulation's Impact on Digital Asset Trading Markets

- Wzzph Analyzes Crypto Market Maturation as Institutional Capital Drives $50B ETF Inflows

- GXCYPX Analyzes South America's Emerging Digital Asset Market Dynamics

- Keyanb Crypto Exchange Positions for Latin America's $600 Billion Remittance Opportunity Amid Global Regulatory Shifts