Trending...

- Maryland Department of Agriculture Accepting 2026 Animal Waste Technology Fund Proposals - 103

- Maryland: Invasive Plant Advisory Committee (IPAC) Meeting Notice

- Maryland: Preliminary Testing Confirms Highly Pathogenic Avian Influenza in Third Anne Arundel County Backyard Flock in 2025

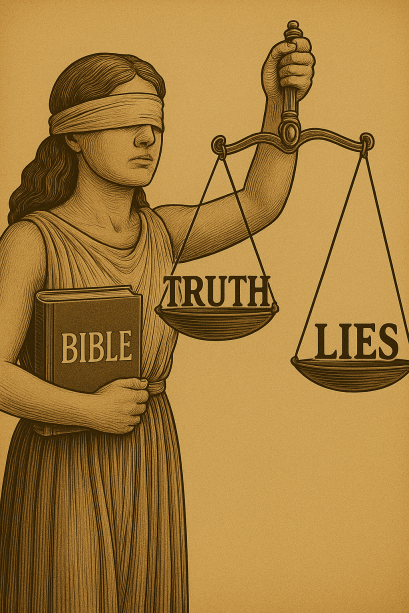

The truth needs to be told when billionaire hijacks true facts

LONDON - Marylandian -- Date: August 13, 2025**

New York / London

⸻

MYTH vs. FACT: The Truth About the Astor Loan with Ricardo Salinas as told by Val Sklarov

New York — In light of recent public statements and speculation, Val Sklarov sets the record straight on the July 28, 2021 loan agreement with Ricardo Salinas Pliego and Astor Asset Management 3 Ltd ("Astor 3").

⸻

MYTH #1: That Astor 3 or Val Sklarov had stated that Val Sklarov or Astor 3 is descendant of Astor 3.

FACT: Astor 3 was formed in Canada at the request of Salinas. He had signed 2 identical loan agreements and had decided he wanted a Canadian based lender. He then requested that Astor 3 of Canada is formed as a Special Purpose Vehicle (SPV) just for him. Val Sklarov never said anything about any Astor family and this is pure fabrication and this is true fact.

⸻

MYTH #2: The shares pledged as collateral could not be rehypothecated.

FACT: The agreement granted unconditional rehypothecation rights. From day one, Astor 3 could rehypothecate, barter, pawn, charge, lend, re-pledge, transfer or lend the shares without further consent. That's how the loan contract is written and this is true fact.

⸻

MYTH #3: Salinas did not give a Power of Attorney (POA) over his pledge account.

FACT: False. Salinas had signed two documents titled Custodian Management Agreement (CMA) which is identical to a POA, giving Astor 3 unrestricted rights and control over the pledge account containing the securities and this is true fact.

⸻

MYTH #4: Rehypothecation was limited or restricted.

FACT: There were no restrictions. The rights were absolute, permanent, and acknowledged by Mr. Salinas in the contract he signed after his lawyers reviewed it and approved it. He allegedly has 300 lawyers working for him. Astor 3 had absolute Rehypothecation rights and this is true fact.

More on Marylandian

⸻

MYTH #5: Salinas was unaware of his rights.

FACT: His legal team consisting of 300 lawyers reviewed, negotiated and approved all the loan documents. The rights were stated in plain language. The idea that he "didn't know" is not credible and this is true fact.

⸻

MYTH #6: All the interest and loan fees were paid for by Salinas according to contract terms.

FACT: Not true. Salinas paid interest only two times in 3 years and never paid other mandatory fees. As a banker, he should know to pay on time, but he didn't, being late 1 year the two times he paid and this is true fact.

⸻

MYTH #7: Default meant Salinas could still redeem the shares.

FACT: The agreement contained a waiver of redemption rights. Upon default, Astor 3 had zero obligation to return any collateral — it could liquidate immediately and retain all proceeds up to full repayment and this is true fact.

⸻

MYTH #8: The terms were one-sided or exploitative.

FACT: Both parties were sophisticated and represented by top legal counsel. Astor 3 bore significant risk, including market risk on volatile Elektra shares. Terms reflected that risk, as in any institutional securities-backed lending deal and this is true fact.

⸻

MYTH #9: The deal was secretive or unusual.

FACT: The structure was standard for institutional finance. The only "unusual" element was that Mr. Salinas personally requested a Canadian SPV be created for the transaction, after rejecting earlier U.S. and St. Kitts SOV's for tax and jurisdiction reasons and this is true fact.

⸻

MYTH #10: The lender couldn't call for more collateral.

FACT: The agreement allowed margin calls if the market value of Elektra shares dropped, ensuring the loan-to-value ratio stayed within agreed limits and this is true fact.

⸻

MYTH #11: That Salinas complied with all the terms of the loan.

FACT: Salinas had failed to comply with many provisions of the loan. He refuses to address the 20 breaches of the loan agreement and keeps making reference to Astor family in order to detract from the contract breaches and this is true fact.

More on Marylandian

⸻

MYTH #12: The contract lacked legal safeguards for the lender.

FACT: It contained multiple waivers — fiduciary duty, unjust enrichment, implied covenant, and broad limitation of liability — plus a balance of equities clause favoring the lender in any dispute and this is true fact.

⸻

MYTH #13: The deal was somehow not binding.

FACT: The loan was valid, binding, and enforceable from the moment it was signed. It complied fully with UK law governing pledge of collateral in a loan and this is true fact.

⸻

MYTH #14: Salinas is owed money because Astor 3 did not fund in full.

FACT: Salinas has been funded in full, the sum of US $110 million and does not allege to be owed any money and this is true fact.

⸻

MYTH #15: Salinas wants his collateral back.

FACT: Salinas has already used the loan proceeds and had repurchased all the pledged shares back for less than the loan amount. Salina's repurchased all the shares for approximately US $68 million, while the loan was for US $110 million. Effectively, Salinas made a profit of US $42 million and this is true fact.

⸻

MYTH #16: Salinas believed he was dealing with the famous Astor family.

FACT: Neither Val Sklarov, nor Astor 3 has ever spoken to Salinas. What he believed is a figment of his imagination fed to Salinas by his own trusted agents and this is true fact.

⸻

MYTH #17: Salinas does not know why he defaulted.

FACT: Salinas has been sent 8 Amended Notices of Default. He refuses to respond to them and this is true fact.

⸻

MYTH #18: Lawyers representing Salinas have always told the truth.

FACT: Unfortunately, that's not the case. Salinas lawyers have been fabricating events at the instruction of Salinas and this is true fact. The misrepresentations made by Salinas lawyers to UK court have caused us to repeatedly resort to media to deliver the truth and this is true fact.

Val Sklarov's Closing Statement:

"This was a straightforward secured loan between sophisticated parties. Mr. Salinas got the liquidity he wanted on the terms he agreed to. We performed exactly as contracted. I never said anything about any Astor family and I never met or spoken to Salinas. Any claim otherwise is fiction."

⸻

New York / London

⸻

MYTH vs. FACT: The Truth About the Astor Loan with Ricardo Salinas as told by Val Sklarov

New York — In light of recent public statements and speculation, Val Sklarov sets the record straight on the July 28, 2021 loan agreement with Ricardo Salinas Pliego and Astor Asset Management 3 Ltd ("Astor 3").

⸻

MYTH #1: That Astor 3 or Val Sklarov had stated that Val Sklarov or Astor 3 is descendant of Astor 3.

FACT: Astor 3 was formed in Canada at the request of Salinas. He had signed 2 identical loan agreements and had decided he wanted a Canadian based lender. He then requested that Astor 3 of Canada is formed as a Special Purpose Vehicle (SPV) just for him. Val Sklarov never said anything about any Astor family and this is pure fabrication and this is true fact.

⸻

MYTH #2: The shares pledged as collateral could not be rehypothecated.

FACT: The agreement granted unconditional rehypothecation rights. From day one, Astor 3 could rehypothecate, barter, pawn, charge, lend, re-pledge, transfer or lend the shares without further consent. That's how the loan contract is written and this is true fact.

⸻

MYTH #3: Salinas did not give a Power of Attorney (POA) over his pledge account.

FACT: False. Salinas had signed two documents titled Custodian Management Agreement (CMA) which is identical to a POA, giving Astor 3 unrestricted rights and control over the pledge account containing the securities and this is true fact.

⸻

MYTH #4: Rehypothecation was limited or restricted.

FACT: There were no restrictions. The rights were absolute, permanent, and acknowledged by Mr. Salinas in the contract he signed after his lawyers reviewed it and approved it. He allegedly has 300 lawyers working for him. Astor 3 had absolute Rehypothecation rights and this is true fact.

More on Marylandian

- Youth Take the Lead: Kopp Foundation for Diabetes Hosts "By Youth, For Youth, With T1D" Gala on October 8 at Blue Bell Country Club

- DLA awards UnityTec $48.5M Task Order for Google Cloud Platform and Professional Services

- Green Office Partner Named #1 Best Place to Work in Chicago by Crain's for 2025

- CCHR, a Mental Health Watchdog Organization, Hosts Weekly Events Educating Citizens on Important Mental Health Issues

- "Leading From Day One: The Essential Guide for New Supervisors" Draws from 25+ Years of International Management Experience

⸻

MYTH #5: Salinas was unaware of his rights.

FACT: His legal team consisting of 300 lawyers reviewed, negotiated and approved all the loan documents. The rights were stated in plain language. The idea that he "didn't know" is not credible and this is true fact.

⸻

MYTH #6: All the interest and loan fees were paid for by Salinas according to contract terms.

FACT: Not true. Salinas paid interest only two times in 3 years and never paid other mandatory fees. As a banker, he should know to pay on time, but he didn't, being late 1 year the two times he paid and this is true fact.

⸻

MYTH #7: Default meant Salinas could still redeem the shares.

FACT: The agreement contained a waiver of redemption rights. Upon default, Astor 3 had zero obligation to return any collateral — it could liquidate immediately and retain all proceeds up to full repayment and this is true fact.

⸻

MYTH #8: The terms were one-sided or exploitative.

FACT: Both parties were sophisticated and represented by top legal counsel. Astor 3 bore significant risk, including market risk on volatile Elektra shares. Terms reflected that risk, as in any institutional securities-backed lending deal and this is true fact.

⸻

MYTH #9: The deal was secretive or unusual.

FACT: The structure was standard for institutional finance. The only "unusual" element was that Mr. Salinas personally requested a Canadian SPV be created for the transaction, after rejecting earlier U.S. and St. Kitts SOV's for tax and jurisdiction reasons and this is true fact.

⸻

MYTH #10: The lender couldn't call for more collateral.

FACT: The agreement allowed margin calls if the market value of Elektra shares dropped, ensuring the loan-to-value ratio stayed within agreed limits and this is true fact.

⸻

MYTH #11: That Salinas complied with all the terms of the loan.

FACT: Salinas had failed to comply with many provisions of the loan. He refuses to address the 20 breaches of the loan agreement and keeps making reference to Astor family in order to detract from the contract breaches and this is true fact.

More on Marylandian

- New Slotozilla Project Explores What Happens When the World Goes Silent

- IASO Bio to Present Promising Findings on Equecabtagene Autoleucel for Multiple Sclerosis at both ANA and ECTRIMS 2025

- The Two Faces of Charles D. Braun: How the Novel, Posthumously Yours, Came to Life

- Goodwill Industries of the Chesapeake Celebrates Second Graduating Class from Excel Center, Baltimore's Tuition-Free Adult High School

- Counseling Center of New Smyrna Beach Expands Affordable Mental Health Services for Volusia County

⸻

MYTH #12: The contract lacked legal safeguards for the lender.

FACT: It contained multiple waivers — fiduciary duty, unjust enrichment, implied covenant, and broad limitation of liability — plus a balance of equities clause favoring the lender in any dispute and this is true fact.

⸻

MYTH #13: The deal was somehow not binding.

FACT: The loan was valid, binding, and enforceable from the moment it was signed. It complied fully with UK law governing pledge of collateral in a loan and this is true fact.

⸻

MYTH #14: Salinas is owed money because Astor 3 did not fund in full.

FACT: Salinas has been funded in full, the sum of US $110 million and does not allege to be owed any money and this is true fact.

⸻

MYTH #15: Salinas wants his collateral back.

FACT: Salinas has already used the loan proceeds and had repurchased all the pledged shares back for less than the loan amount. Salina's repurchased all the shares for approximately US $68 million, while the loan was for US $110 million. Effectively, Salinas made a profit of US $42 million and this is true fact.

⸻

MYTH #16: Salinas believed he was dealing with the famous Astor family.

FACT: Neither Val Sklarov, nor Astor 3 has ever spoken to Salinas. What he believed is a figment of his imagination fed to Salinas by his own trusted agents and this is true fact.

⸻

MYTH #17: Salinas does not know why he defaulted.

FACT: Salinas has been sent 8 Amended Notices of Default. He refuses to respond to them and this is true fact.

⸻

MYTH #18: Lawyers representing Salinas have always told the truth.

FACT: Unfortunately, that's not the case. Salinas lawyers have been fabricating events at the instruction of Salinas and this is true fact. The misrepresentations made by Salinas lawyers to UK court have caused us to repeatedly resort to media to deliver the truth and this is true fact.

Val Sklarov's Closing Statement:

"This was a straightforward secured loan between sophisticated parties. Mr. Salinas got the liquidity he wanted on the terms he agreed to. We performed exactly as contracted. I never said anything about any Astor family and I never met or spoken to Salinas. Any claim otherwise is fiction."

⸻

Source: Astor Asset Management 3 Ltd

Filed Under: Business

0 Comments

Latest on Marylandian

- DivX Unveils New Educational Blog Series to Simplify MKV to MP4 Video Conversion

- Baltimore Gets Its Own Namesake Sandwich as The Tillery Launches the B.A.L.T.I.M.O.R.E.

- CCHR: For Prevention, Families Deserve Truth From NIH Study on Psychiatric Drugs

- Rock Band Black Halo Releases Debut Single, "Upon Deaf Ears"

- Sheets.Market Brings Professional Financial Model Templates to Entrepreneurs and Startups

- Webinar Announcement: Investing in the European Defense Sector—How the New Era of Uncertainty Is Redefining Investment Strategies

- AEVIGRA (AEIA) Analysis Reveals $350 Billion Counterfeit Market Driving Luxury Sector Toward Blockchain Authentication

- RUNA Brings Celtic Spirit and American Roots to New Spire Stages

- Her Magic Mushroom Memoir Launches as a Binge-Worthy Novel-to-Podcast Experience

- Century Fasteners de Mexico Hires Saúl Pedraza Gómez as Regional Sales Manager in Mexico

- Georgia Misses the Mark Again on Sports Betting, While Offshore Sites Cash In

- Maryland: Invasive Plant Advisory Committee (IPAC) Meeting Notice

- $40 Price Target for $NRXP in H. C. Wainright Analyst Report on Leader in $3 Billion Suicidal Depression Market with Superior NRX 100 Drug Therapy

- Nashville International Chopin Piano Competition Partners with Crimson Global Academy to Support Excellence in Education

- AHRFD Releases Market Analysis: Cryptocurrency Market's Institutional Transformation Accelerating

- Ubleu Crypto Group Analyzes European Digital Asset Market Opportunities Amid Regulatory Evolution

- NIUFO Examines European MiCA Regulation's Impact on Digital Asset Trading Markets

- Wzzph Analyzes Crypto Market Maturation as Institutional Capital Drives $50B ETF Inflows

- GXCYPX Analyzes South America's Emerging Digital Asset Market Dynamics

- Keyanb Crypto Exchange Positions for Latin America's $600 Billion Remittance Opportunity Amid Global Regulatory Shifts