Trending...

- JudyMaids Launches "Clean Homes, Full Plates" Fall Food Drive to Support Manna Food Center

- dpInk Ltd. Liability Company Ignites Strategic Growth for Small Businesses and Visionary Enterprises

- KeysCaribbean Offers 20 Percent Off Seven-Night Stays For Private Home Collection Properties

$IQST is a Global Communications Leader Scaling with High-Tech, High-Margin Growth Strategy

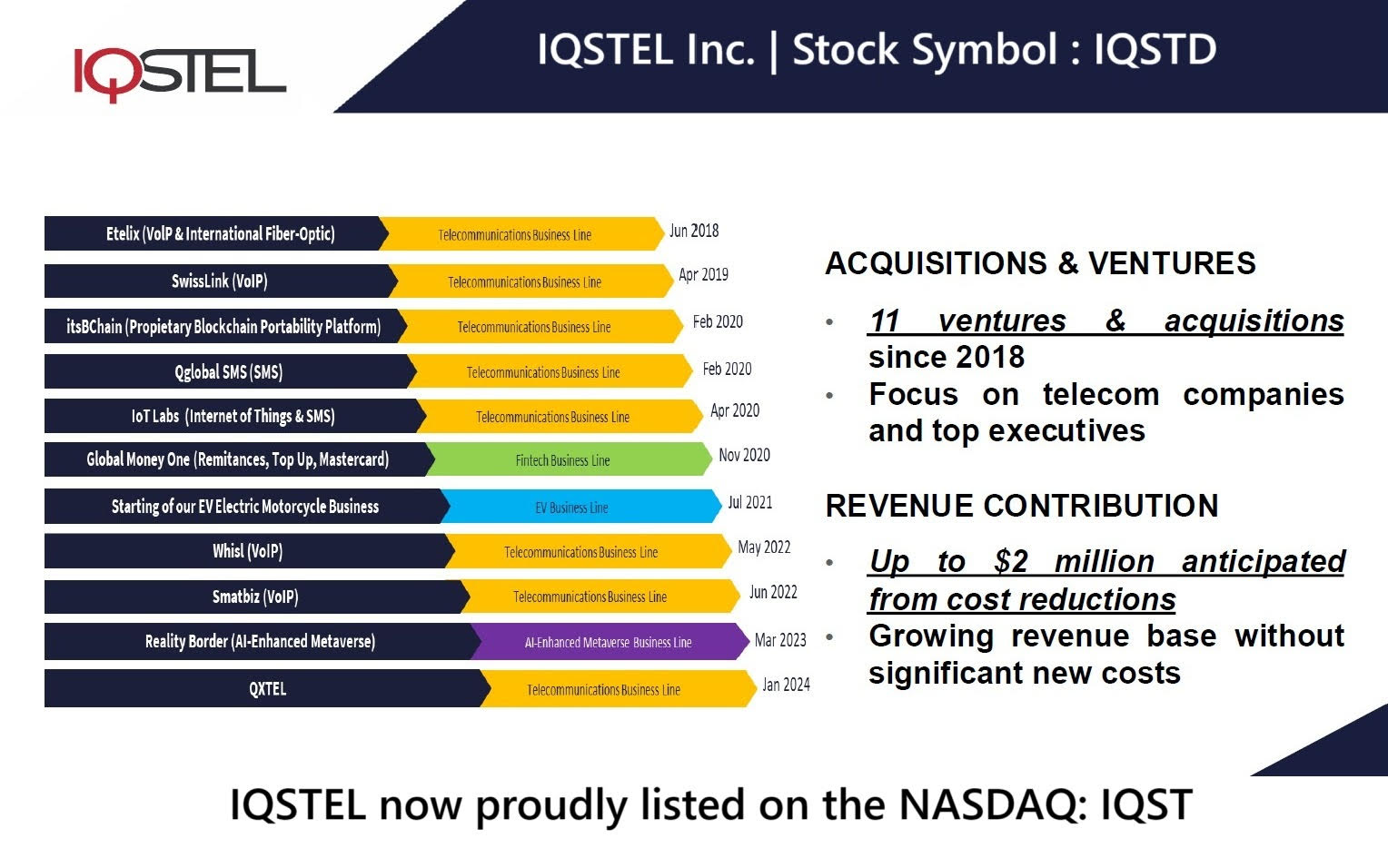

CORAL GABLES, Fla. - Marylandian -- IQSTEL, Inc. (N A S D A Q: IQST) is not just a telecom company anymore — it's emerging as a diversified technology powerhouse with bold ambitions and the roadmap to back them up.

With an impressive $400M annual revenue run rate already achieved five months ahead of schedule, IQSTEL is setting the stage for a $15 million EBITDA run rate in 2026 and a $1 billion revenue milestone by 2027. This rapid growth trajectory, backed by cutting-edge innovations in Telecom, Fintech, Artificial Intelligence, Blockchain, Electric Vehicles, and Cybersecurity, positions IQSTEL as one of the most dynamic emerging tech stories on the N A S D A Q.

🔥 Why Investors Are Watching IQST Closely:

💸 $6.9 Million Debt Cut — Almost $2 Per Share in Value Unlocked

IQSTEL continues to strengthen its balance sheet, eliminating $6.9 million in debt — a move that directly enhances shareholder value and reinforces long-term growth. This cut translates to nearly $2 per share, delivering significant intrinsic value while improving financial flexibility.

📈 $35M in July Revenue – Rocketing Past $400M Run Rate

In July alone, IQSTEL reported $35 million in revenue, placing the company well on track to hit — and likely exceed — its FY-2025 revenue target of $340 million. The growth is organic and consistent, underscoring IQST's proven execution capabilities.

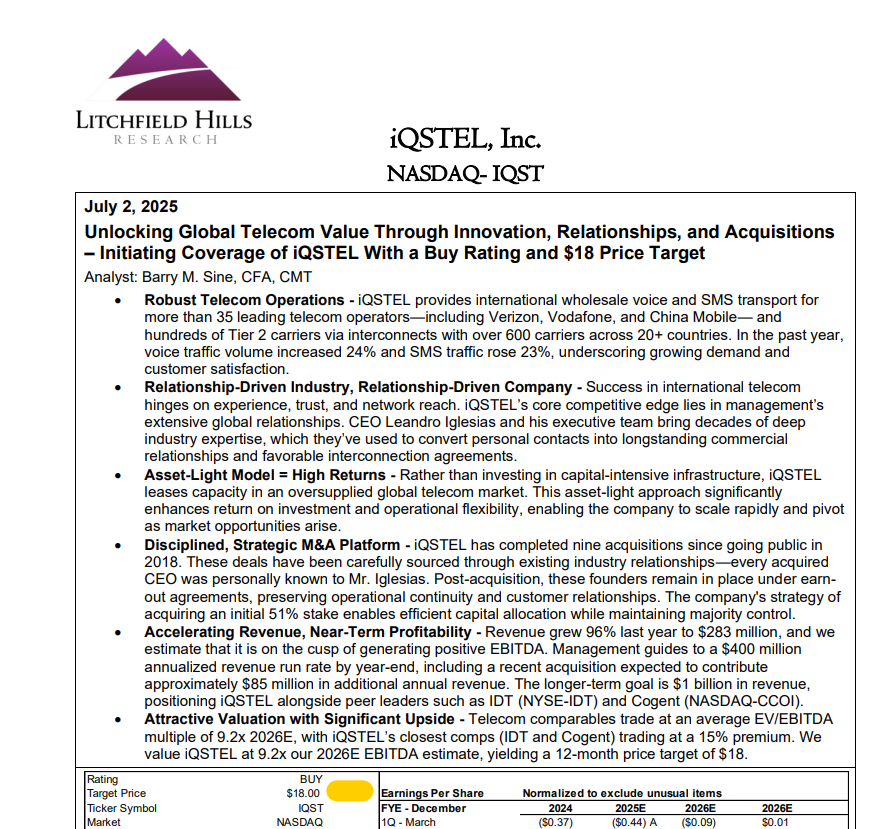

🔍 Litchfield Hills Research Reaffirms $18 Price Target

Following IQST's Q2 2025 results, Litchfield Hills Research reiterated its $18 price target, highlighting the company's rising EBITDA, strong equity position, and growing market influence. This implies a multi-fold upside from current levels, driven by strong fundamentals and strategic vision.

💡 Next-Generation AI Solutions: IQ2Call and Reality Border

IQSTEL is redefining the call center model with IQ2Call, a proprietary AI-powered platform created through its AI subsidiary Reality Border LLC. This transformative solution blends real-time AI automation with human intelligence, setting a new standard for efficiency and customer experience in the $750B global contact center industry.

More on Marylandian

🚑 Healthcare Sector Focus: IQST has partnered with Mobility Tech, a top-tier call center firm specializing in U.S. healthcare. This collaboration brings next-gen AI directly to one of the most demanding sectors, driving high-margin enterprise adoption.

🧭 The Roadmap: From $400M Run Rate to $1 Billion Revenue

IQSTEL's aggressive growth plan is underpinned by a clear strategic path:

The company's two-pronged "pincer strategy" — strategic acquisitions and organic high-margin growth — is already in motion. IQST is targeting 2–3 acquisitions, each expected to contribute approximately $5 million in EBITDA, further accelerating growth and shareholder value.

🔄 Shareholder Value at the Core: Equity Exchange with CYCU

IQSTEL is enhancing shareholder value with a unique equity partnership with CYCU, involving a $1 million stock exchange. Notably, half of the exchanged shares will be distributed as a dividend — a shareholder-friendly move rarely seen in growth-stage tech firms.

📊 Q2 2025 Financial Highlights: Record Metrics Across the Board

🌍 Strategic Acquisitions: GlobeTopper Now Consolidated

IQST officially closed its 51% acquisition of GlobeTopper as of July 1, 2025. This fintech acquisition is forecasted to contribute:

GlobeTopper expands IQST's fintech footprint and brings a global customer base, new tech capabilities, and cross-selling synergies.

More on Marylandian

🔒 Diversified, Global, and Built for the Future

Operating in 21 countries, IQSTEL has evolved into a truly global force, uniquely positioned to capitalize on converging trends in AI, Fintech, and Connectivity. From EV technology to cybersecurity solutions, IQSTEL's diversified portfolio delivers high-margin, high-impact services tailored for the next decade.

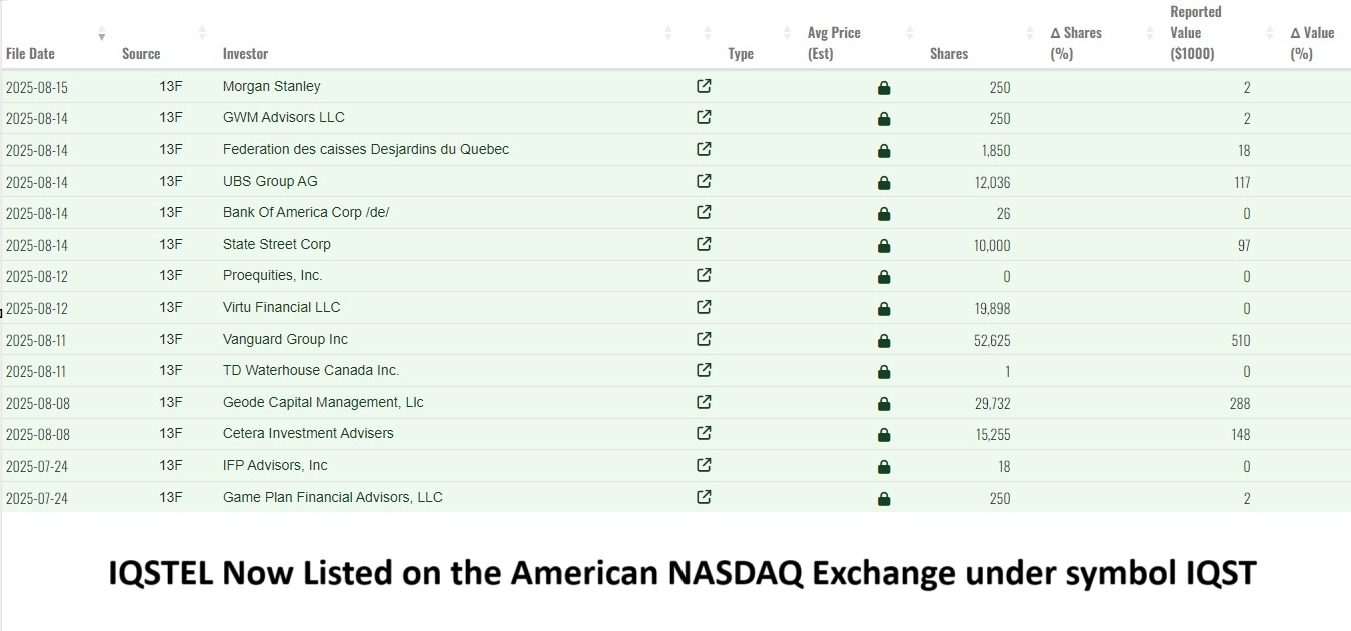

📣 Institutional Interest Rising

Since uplisting to Nasdaq just 120 days ago, approximately 12 institutional investors now hold 4% of IQST shares, signaling growing confidence in the company's vision and execution.

📊 Nasdaq Institutional Holdings: View here

✅ Bottom Line: IQSTEL Is a Billion-Dollar Story in the Making

IQSTEL (N A S D A Q: IQST) is firing on all cylinders — delivering consistent growth, eliminating debt, innovating with AI, and expanding through smart acquisitions. With a strong foundation, clear roadmap, and expanding market footprint, IQST offers investors a compelling opportunity to participate in a high-growth, tech-enabled global transformation.

📈 Price Target: $18 (Litchfield Hills Research)

🎯 Revenue Goal: $1 Billion by 2027

💼 2026 EBITDA Target: $15 Million

🌐 Visit: www.IQSTEL.com

Media Contact:

Leandro Jose Iglesias – President & CEO

📧 investors@iqstel.com

📞 +1 954-951-8191

🌍 www.IQSTEL.com

Disclaimer: This article is for informational purposes only and should not be considered investment advice. Always conduct your own due diligence. https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

With an impressive $400M annual revenue run rate already achieved five months ahead of schedule, IQSTEL is setting the stage for a $15 million EBITDA run rate in 2026 and a $1 billion revenue milestone by 2027. This rapid growth trajectory, backed by cutting-edge innovations in Telecom, Fintech, Artificial Intelligence, Blockchain, Electric Vehicles, and Cybersecurity, positions IQSTEL as one of the most dynamic emerging tech stories on the N A S D A Q.

🔥 Why Investors Are Watching IQST Closely:

💸 $6.9 Million Debt Cut — Almost $2 Per Share in Value Unlocked

IQSTEL continues to strengthen its balance sheet, eliminating $6.9 million in debt — a move that directly enhances shareholder value and reinforces long-term growth. This cut translates to nearly $2 per share, delivering significant intrinsic value while improving financial flexibility.

📈 $35M in July Revenue – Rocketing Past $400M Run Rate

In July alone, IQSTEL reported $35 million in revenue, placing the company well on track to hit — and likely exceed — its FY-2025 revenue target of $340 million. The growth is organic and consistent, underscoring IQST's proven execution capabilities.

🔍 Litchfield Hills Research Reaffirms $18 Price Target

Following IQST's Q2 2025 results, Litchfield Hills Research reiterated its $18 price target, highlighting the company's rising EBITDA, strong equity position, and growing market influence. This implies a multi-fold upside from current levels, driven by strong fundamentals and strategic vision.

💡 Next-Generation AI Solutions: IQ2Call and Reality Border

IQSTEL is redefining the call center model with IQ2Call, a proprietary AI-powered platform created through its AI subsidiary Reality Border LLC. This transformative solution blends real-time AI automation with human intelligence, setting a new standard for efficiency and customer experience in the $750B global contact center industry.

More on Marylandian

- Poised for Major Growth with Strategic Military Orders, Global Expansion, and Groundbreaking Underground Mining Initiative $RMXI

- XRP fever is coming again, WOA Crypto helps the new trend and earns tens of thousands of dollars a day

- Helen Welch Stars in "Carpenters: The Songs. The Stories" at New Spire Arts

- Inflation Rebounds Under Tariff Shadow: Wall Street Veteran Kieran Winterbourne Says Macro Signals Matter More Than Market Sentiment

- Mensa Foundation's New Science Program Encourages Hands-On Discovery

🚑 Healthcare Sector Focus: IQST has partnered with Mobility Tech, a top-tier call center firm specializing in U.S. healthcare. This collaboration brings next-gen AI directly to one of the most demanding sectors, driving high-margin enterprise adoption.

🧭 The Roadmap: From $400M Run Rate to $1 Billion Revenue

IQSTEL's aggressive growth plan is underpinned by a clear strategic path:

- 2025 – Build on the $400M revenue run rate, optimize for margins, and reduce debt.

- 2026 – Reach a $15M EBITDA run rate, triggering potential market capitalization of $150M–$300M based on standard EBITDA multiples.

- 2027 – Achieve $1B in revenue, positioning IQST among the top global tech leaders.

The company's two-pronged "pincer strategy" — strategic acquisitions and organic high-margin growth — is already in motion. IQST is targeting 2–3 acquisitions, each expected to contribute approximately $5 million in EBITDA, further accelerating growth and shareholder value.

🔄 Shareholder Value at the Core: Equity Exchange with CYCU

IQSTEL is enhancing shareholder value with a unique equity partnership with CYCU, involving a $1 million stock exchange. Notably, half of the exchanged shares will be distributed as a dividend — a shareholder-friendly move rarely seen in growth-stage tech firms.

📊 Q2 2025 Financial Highlights: Record Metrics Across the Board

- Net Shareholder Equity: Grew from $11.9M to $14.29M (pre-July debt reduction).

- Gross Revenue: $155.15M in H1 2025, 17% YoY growth, fully organic.

- Gross Margin: Improved 7.45% YoY.

- Telecom Net Income: +29.94% QoQ.

- Adjusted EBITDA: $1.1 million for H1 2025.

- Assets per Share: $17.41 | Equity per Share: $4.84 (pre-debt cut).

🌍 Strategic Acquisitions: GlobeTopper Now Consolidated

IQST officially closed its 51% acquisition of GlobeTopper as of July 1, 2025. This fintech acquisition is forecasted to contribute:

- $34 million in revenue

- $260K in EBITDA in H2 2025

- Starting at $5M in July, scaling to $6M+ by December

GlobeTopper expands IQST's fintech footprint and brings a global customer base, new tech capabilities, and cross-selling synergies.

More on Marylandian

- Golden Paper Introduces TAD Hand Towel Technology, Ushering in a New Era of Premium Tissue Quality

- ReedSmith® Creates Founder-Investor Connections at The Investor Dating Game™ by Tech Coast Venture Network During LA Tech Week

- OfficeSpaces.co Expands Its AI-Powered Website Builder Across North America

- Tobu Railway Group Will Host the Fourth Annual "Take-Akari" Bamboo Lantern Festival in East Tokyo, November 7, 2025 – January 31, 2026

- New Article by Roy J. Meidinger – Examines Hidden Hidden Healthcare Kickbacks

🔒 Diversified, Global, and Built for the Future

Operating in 21 countries, IQSTEL has evolved into a truly global force, uniquely positioned to capitalize on converging trends in AI, Fintech, and Connectivity. From EV technology to cybersecurity solutions, IQSTEL's diversified portfolio delivers high-margin, high-impact services tailored for the next decade.

📣 Institutional Interest Rising

Since uplisting to Nasdaq just 120 days ago, approximately 12 institutional investors now hold 4% of IQST shares, signaling growing confidence in the company's vision and execution.

📊 Nasdaq Institutional Holdings: View here

✅ Bottom Line: IQSTEL Is a Billion-Dollar Story in the Making

IQSTEL (N A S D A Q: IQST) is firing on all cylinders — delivering consistent growth, eliminating debt, innovating with AI, and expanding through smart acquisitions. With a strong foundation, clear roadmap, and expanding market footprint, IQST offers investors a compelling opportunity to participate in a high-growth, tech-enabled global transformation.

📈 Price Target: $18 (Litchfield Hills Research)

🎯 Revenue Goal: $1 Billion by 2027

💼 2026 EBITDA Target: $15 Million

🌐 Visit: www.IQSTEL.com

Media Contact:

Leandro Jose Iglesias – President & CEO

📧 investors@iqstel.com

📞 +1 954-951-8191

🌍 www.IQSTEL.com

Disclaimer: This article is for informational purposes only and should not be considered investment advice. Always conduct your own due diligence. https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Source: Corporate Ads

Filed Under: Business

0 Comments

Latest on Marylandian

- TKL Group's New Factory Commences Production, Pioneering A New Era In Global Heavy Duty Truck Parts

- Regulated Crypto Exchange TZNXG Addresses Core US Market Challenges with Compliance-First Infrastructure

- GitKraken Launches Insights to Help Engineering Leaders Quantify AI Impact and Improve Developer Experience

- ZapperBox NextGen TV Gateway Receiver Now Testing Support For Secure Whole-Home Content Distribution

- Life as a Dog: P-Wave Press Brings Readers a Heartwarming Memoir of Love, Laughter and Companionship

- NOYA Launches Premium, Design-Forward Training Gear That Belongs at the Center of Your Space

- Research Defense Examines Violence, Illiteracy, Non-Active Fathers, and Low Self-Esteem Among Males

- Investing in Greece: Your Definitive Real-Estate FAQ Guide

- KeysCaribbean Offers 20 Percent Off Seven-Night Stays For Private Home Collection Properties

- Advancing Circular Economy in Automotive ESD Packaging

- Institute for Pet Health Sciences Names Boops Pets 2025 Product of the Year

- Matthew Cossolotto, Author of The Joy of Public Speaking, Appears on "Get Authentic with Marques Ogden" and "Achieving Success with Olivia Atkin"

- CCHR Exposes Conflicted Psychiatrists Behind Teen Antidepressant Surge

- WIBO Announces Fall 2025 Entrepreneurship Programs to Empower NYC Founders and Small Business Owners

- Local College Student Launches "Cleopatra" App to Make Cleaning Easy for Mercer County Residents

- Wohler announces release of additional Balance Control output tracking for its eSeries in-rack monitor range

- A Milestone of Giving: Ten Percent Group Donates £25,000 to Cure Parkinson's

- Tami Goveia Enters FabOver40, Inspiring Hollywood Legacy for Breast Cancer Cause

- Swidget Launches Luminance™ to Help Schools Achieve Alyssa's Law Compliance

- Growing Demand for EVA Mats Signals Shift in Car Interior Market