Trending...

- $167 Billion Pharma R&D Market Largely Untapped by AI Creates Major Growth Runway for KALA Bios Data-Sovereign AI Strategy: N A S D A Q: KALA

- Food Journal Magazine Raises the Standard for Restaurant Reviews in Los Angeles

- Pregis Expands Wind Energy Use, Advancing Progress Toward Net Zero by 2040

$100 Million in Listings and $35 Million Closed: Off The Hook YS (N Y S E American: OTH) $OTH Accelerates into Luxury Yachting with Autograph Yacht Group

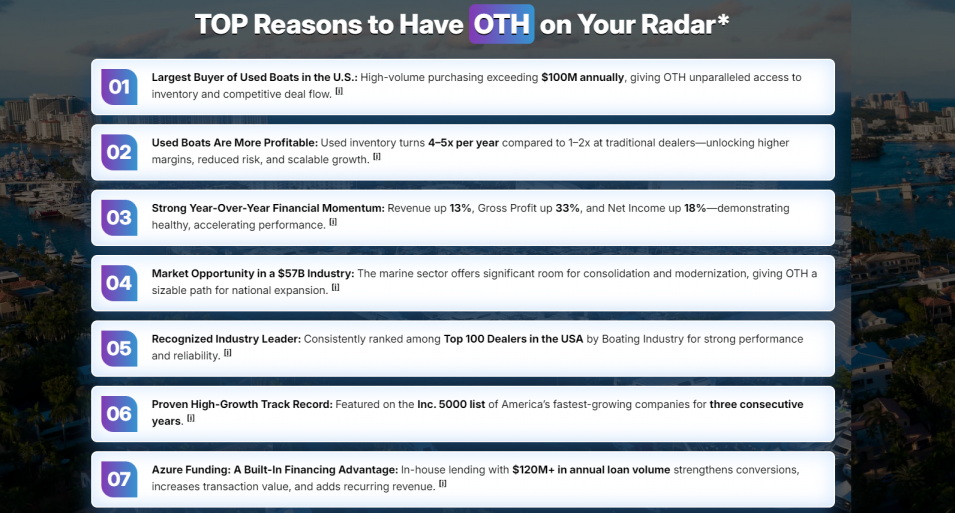

WILMINGTON, N.C. - Marylandian -- Off The Hook YS Inc. (NYSE American: OTH) is rapidly redefining liquidity, transparency, and scale in the $57 billion U.S. marine industry. Following its successful November 2025 IPO, the company has entered a powerful new growth phase—highlighted by explosive early results from its newly launched luxury brokerage division, Autograph Yacht Group (AYG).

Since its October 2025 launch, Autograph Yacht Group has already secured over $100 million in luxury yacht listings and closed 22 transactions totaling approximately $35 million, signaling immediate traction in the high-end segment of the market. These early results underscore OTH's ability to translate its technology-driven wholesale platform into premium brokerage execution—an evolution few competitors have successfully achieved.

A Scaled Platform in a Fragmented Industry

Founded in 2012 by CEO Jason Ruegg, Off The Hook YS has grown into one of America's largest buyers and sellers of pre-owned boats, acquiring more than $100 million in boats and yachts annually. Headquartered in Wilmington, North Carolina, with operations across the East Coast and South Florida, OTH operates a nationwide network of offices and marinas, providing brokerage, wholesale, financing, and performance yacht sales under one integrated platform.

What differentiates OTH is its AI-assisted valuation engine and data-driven sales platform, which bring speed, pricing accuracy, and transparency to a traditionally opaque market. This proprietary technology enables OTH to operate as a liquidity provider—connecting buyers and sellers faster while managing inventory risk more effectively than traditional brokerages.

The company's execution has earned consistent recognition, including placement on the Inc. 500 and ranking among the Top 100 Boat Dealers in the United States.

Autograph Yacht Group: A Luxury Brokerage with Structural Advantages

More on Marylandian

Autograph Yacht Group was launched to target yachts generally ranging from $500,000 to $20 million and above, focusing on high-discretion clients seeking a curated, boutique experience. Unlike traditional luxury brokerages, Autograph can accept trade-ins, a capability enabled by OTH's wholesale and AI-driven valuation infrastructure.

This creates a structural advantage:

Autograph's AI engine intelligently matches buyers and sellers by analyzing vessel data, client preferences, transaction history, and market conditions—enhancing both conversion rates and customer experience.

The division currently operates from waterfront offices in Jupiter and Fort Lauderdale, Florida, with the newly announced Jupiter, FL office serving as Autograph Yacht Group's headquarters. The location places OTH at the center of one of the most active luxury boating corridors in the United States.

Strong Financial Momentum and Record Operating Metrics

OTH's operational momentum extends well beyond luxury brokerage.

Nine-Month 2025 Highlights (Ended September 30, 2025):

Third Quarter 2025 Highlights:

2026 Outlook: Scaling Toward $145 Million in Revenue

Building on its expanding platform and strong Q4 momentum, OTH has issued 2026 full-year revenue guidance of $140 million to $145 million—a significant step up from current levels and a reflection of expanding market share, improving margins, and growing contributions from luxury brokerage and financing operations.

More on Marylandian

The company also stands to benefit from favorable macro and policy tailwinds. In July 2025, the "One Big Beautiful Bill Act" reinstated 100% bonus depreciation for qualifying boats and yachts purchased by January 19, 2026, allowing eligible business buyers to deduct the full purchase price in year one. Management reports this incentive has already boosted demand and is expected to further accelerate transaction volume into 2026.

Positioned for Long-Term Industry Growth

Beyond near-term sales momentum, OTH is strategically positioned in multiple expanding markets. The broader U.S. marine industry is valued at $57 billion, while the U.S. ship repair and maintenance services market, valued at $6.55 billion in 2025, is projected to grow to $11.72 billion by 2033 at a 7.52% CAGR. OTH's scale, inventory access, and technology infrastructure provide optionality to participate across these value chains.

Independent Research Coverage Highlights Structural Opportunity

On December 8, 2025, Digital BD Deep initiated in-depth investor coverage with a report titled:

"Off-The-Hook YS: Digital Transformation and Margin Inflection in the Marine Industry – Structural Arbitrage in the Marine Liquidity Market."

The report analyzes OTH's technology-enabled business model, margin expansion potential, and positioning as a liquidity aggregator in a fragmented industry.

Full report available at:

https://www.digitalbdinc.com/report/othdeepresearch12-8-25.pdf

Bottom Line

With a successful IPO completed, record revenues, accelerating unit volumes, and a luxury brokerage division generating meaningful traction in its first quarter, Off The Hook YS Inc. is emerging as a technology-driven consolidator in the U.S. marine market. The combination of AI-powered valuation, nationwide scale, favorable tax policy, and expanding luxury exposure positions OTH for continued growth into 2026 and beyond.

Company: Off The Hook YS Inc. (NYSE American: OTH)

Media & Investor Contact:

Chad Corbin, Chief Financial Officer

Email: IR@offthehookys.com

Phone: (561) 374-0513

Web: www.offthehookyachts.com

Investor Media: https://compasslivemedia.com/oth/

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Since its October 2025 launch, Autograph Yacht Group has already secured over $100 million in luxury yacht listings and closed 22 transactions totaling approximately $35 million, signaling immediate traction in the high-end segment of the market. These early results underscore OTH's ability to translate its technology-driven wholesale platform into premium brokerage execution—an evolution few competitors have successfully achieved.

A Scaled Platform in a Fragmented Industry

Founded in 2012 by CEO Jason Ruegg, Off The Hook YS has grown into one of America's largest buyers and sellers of pre-owned boats, acquiring more than $100 million in boats and yachts annually. Headquartered in Wilmington, North Carolina, with operations across the East Coast and South Florida, OTH operates a nationwide network of offices and marinas, providing brokerage, wholesale, financing, and performance yacht sales under one integrated platform.

What differentiates OTH is its AI-assisted valuation engine and data-driven sales platform, which bring speed, pricing accuracy, and transparency to a traditionally opaque market. This proprietary technology enables OTH to operate as a liquidity provider—connecting buyers and sellers faster while managing inventory risk more effectively than traditional brokerages.

The company's execution has earned consistent recognition, including placement on the Inc. 500 and ranking among the Top 100 Boat Dealers in the United States.

Autograph Yacht Group: A Luxury Brokerage with Structural Advantages

More on Marylandian

- The "Unsexy" Business Quietly Creating 130+ New Entrepreneurs Across America — From Alaska to Puerto Rico

- Veteran Launches GTG Energy: Nicotine-Free Pouch as Americans Rethink Addiction, Focus, and What Fuels Performance

- RecallSentry™ App Launch — Your Home Safety Hub — Free on iOS & Android

- Award-Winning Director Crystal J. Huang's Under-$50K Film "The Ritual House" Wins Best Horror Feature at Golden State Film Festival

- Grads aren't getting hired — here's what we're doing about it

Autograph Yacht Group was launched to target yachts generally ranging from $500,000 to $20 million and above, focusing on high-discretion clients seeking a curated, boutique experience. Unlike traditional luxury brokerages, Autograph can accept trade-ins, a capability enabled by OTH's wholesale and AI-driven valuation infrastructure.

This creates a structural advantage:

- Faster deal velocity

- Expanded buyer pool

- More accurate pricing

- Reduced friction for sellers

Autograph's AI engine intelligently matches buyers and sellers by analyzing vessel data, client preferences, transaction history, and market conditions—enhancing both conversion rates and customer experience.

The division currently operates from waterfront offices in Jupiter and Fort Lauderdale, Florida, with the newly announced Jupiter, FL office serving as Autograph Yacht Group's headquarters. The location places OTH at the center of one of the most active luxury boating corridors in the United States.

Strong Financial Momentum and Record Operating Metrics

OTH's operational momentum extends well beyond luxury brokerage.

Nine-Month 2025 Highlights (Ended September 30, 2025):

- Record revenue: $82.6 million, up 19.3% year-over-year

- Boats sold: 310 units, up 24.4%

- Net income: $0.8 million

- Gross profit: $8.4 million, up from $6.9 million in 2024

- Adjusted EBITDA: $2.6 million

Third Quarter 2025 Highlights:

- Revenue of $24.0 million

- 112 boats sold, up 51.1% YOY

- Second-highest quarterly unit volume in company history

- Gross profit of $3.0 million

- Launch of Autograph Yacht Group

- Addition of 10 new brokers

2026 Outlook: Scaling Toward $145 Million in Revenue

Building on its expanding platform and strong Q4 momentum, OTH has issued 2026 full-year revenue guidance of $140 million to $145 million—a significant step up from current levels and a reflection of expanding market share, improving margins, and growing contributions from luxury brokerage and financing operations.

More on Marylandian

- K2 Integrity Enhances Technology Capabilities Through Acquisition of Leviathan Security Group

- #WeAreGreekWarriors Comes to Detroit in Celebration of Women's History Month

- Natalie Jean Channels Strength Through Softness on New Album Unbreakable Spirit

- Maryland: NEWS RELEASE: Time to CHOW down and Celebrate-Chesapeake Oyster Week March 20-31

- Buildout Launches CRM, Completing the Industry's First AI-Powered End-to-End Deal Engine for CRE

The company also stands to benefit from favorable macro and policy tailwinds. In July 2025, the "One Big Beautiful Bill Act" reinstated 100% bonus depreciation for qualifying boats and yachts purchased by January 19, 2026, allowing eligible business buyers to deduct the full purchase price in year one. Management reports this incentive has already boosted demand and is expected to further accelerate transaction volume into 2026.

Positioned for Long-Term Industry Growth

Beyond near-term sales momentum, OTH is strategically positioned in multiple expanding markets. The broader U.S. marine industry is valued at $57 billion, while the U.S. ship repair and maintenance services market, valued at $6.55 billion in 2025, is projected to grow to $11.72 billion by 2033 at a 7.52% CAGR. OTH's scale, inventory access, and technology infrastructure provide optionality to participate across these value chains.

Independent Research Coverage Highlights Structural Opportunity

On December 8, 2025, Digital BD Deep initiated in-depth investor coverage with a report titled:

"Off-The-Hook YS: Digital Transformation and Margin Inflection in the Marine Industry – Structural Arbitrage in the Marine Liquidity Market."

The report analyzes OTH's technology-enabled business model, margin expansion potential, and positioning as a liquidity aggregator in a fragmented industry.

Full report available at:

https://www.digitalbdinc.com/report/othdeepresearch12-8-25.pdf

Bottom Line

With a successful IPO completed, record revenues, accelerating unit volumes, and a luxury brokerage division generating meaningful traction in its first quarter, Off The Hook YS Inc. is emerging as a technology-driven consolidator in the U.S. marine market. The combination of AI-powered valuation, nationwide scale, favorable tax policy, and expanding luxury exposure positions OTH for continued growth into 2026 and beyond.

Company: Off The Hook YS Inc. (NYSE American: OTH)

Media & Investor Contact:

Chad Corbin, Chief Financial Officer

Email: IR@offthehookys.com

Phone: (561) 374-0513

Web: www.offthehookyachts.com

Investor Media: https://compasslivemedia.com/oth/

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Source: CorporateAds

Filed Under: Business

0 Comments

Latest on Marylandian

- Strong Clinical Results for Breakthrough Liver Diagnostic Platform; ENDRA Life Sciences (N A S D A Q: NDRA) $NDRA

- 46th International Symposium On Forecasting – Dates, Venue And Speakers Announced

- Phoenix Rebellion Therapy Celebrates 10 Years Helping Utahns Overcome Trauma as Utah Faces Nation's 2nd-Highest Rate of Mental Health Challenges

- Bonavita Luxury & Portable Lavatories Announces Rebrand to Bonavita Site Solutions

- Raleigh Emerges as a Key Player in Sustainable Fashion Innovation for 2026

- Notice: Hrm Queen Laurence I Assumes Crown Control & $317q Fund. 3bn Unopoly Shares Settled. Requisition Of Buckingham Palace & Windsor Castle Final

- 13 Full Moons of Black Dandelion Convergent Voice™ An Integration of Literacy & Wellness Symposium

- Yoga Retreats, Ecstatic Dance & Spiritual App launched

- Elder Abuse Case Against Healthy Traditions Owner Raises Questions As To The Dire Reality Of Abuse Against The Last Of The Baby Boomers

- Simpalm Staffing Services Launched its Refreshed Website for Remote Staffing Services

- Maryland: NEWS RELEASE: Department Issues Box Tree Moth (Cydalima perspectalis) Quarantine in Allegany, Frederick, Garrett, and Washington Counties, and Expands Quarantine for Spotted Lanternfly

- Claude Riveloux Review 2026: How the $10B Fund Manager Dispels 'Scam' Rumors Through Education

- Pure Energy Electrical Services, LLC Announces Strong Start to 2026, Reinforcing Customer-First Electrical Service Across Northeast Florida

- Danholm Collection Launches Boutique Luxury Real Estate Brokerage in Central Florida

- Sellvia Market Expands Curated Store Portfolio for Dropshipping Sellers

- Food Journal Magazine Raises the Standard for Restaurant Reviews in Los Angeles

- Williamsville Spa Expands Team to Meet Growing Demand for Professional Facials

- Pregis Expands Wind Energy Use, Advancing Progress Toward Net Zero by 2040

- Maryland: Wicomico County Control Area Released

- Dr. Sheel Desai Solomon and Preston Dermatology Continue Awards Streak with Top Honors in 2026 Maggy Awards